- …

- …

Michael Sidgmore

About Me

Over the past 14 years, I’ve been lucky enough to have a front row seat as the alternative investment space has evolved.

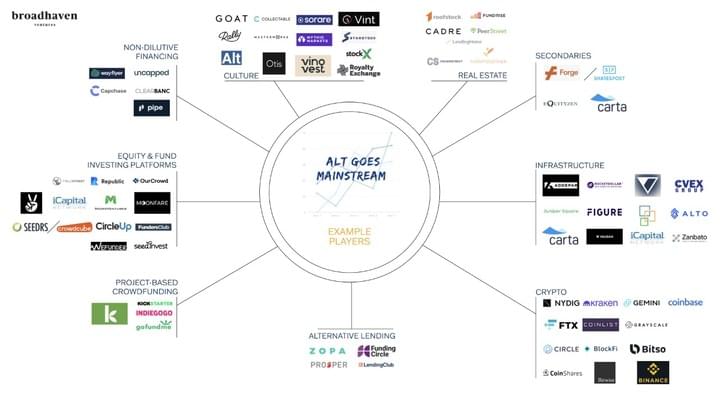

I’m a Partner & Co-Founder of Broadhaven Ventures, a principal investment firm focused on financial services that invests into fintech companies, funds, and incubates asset management businesses, including Cantilever Group, a GP Stakes Fund. I am also the Founder of Alt Goes Mainstream, a leading content platform on private markets. Previously, as an early employee, I helped build the sales team at iCapital Network and worked at Goldman Sachs on the Principal Strategic Investing team.

Broadhaven Ventures has been early investors in Carta, MoneyLion, Republic, Nowports, Covalto (fka Credijusto), Kovi, Liveoak (acq. by DocuSign), 73 Strings, AltExchange (acq. by iCapital), Cantilever, LemonEdge, Alt, Bitso, Allocate, bunch, Brassica (acq. by BitGo), CoinList, Shakepay, DealsPlus, Passthrough, Pluto, and more.

Broadhaven Ventures is affiliated with Broadhaven Capital Partners, a market leading FinTech investment bank that has advised on over $90 billion in transaction volume, including a number of landmark deals in trading and technology (ICE, CBOE, BATS), asset management (Franklin Templeton / Legg Mason $6.6B merger, Franklin Templeton’s $1.75B acquisition of Lexington Partners), and alternative investments (Cambridge Associates, Wilshire Associates, Angelo Gordon’s sales).

I am the founder of podcasting and content platform Alt Goes Mainstream, a leading content platform that delivers the latest developments in the alternative investments space. There is everything from a weekly newsletter on private markets, long-form thought posts to podcasts with industry leaders to keep everyone up to speed with the latest trends in alternative investments.

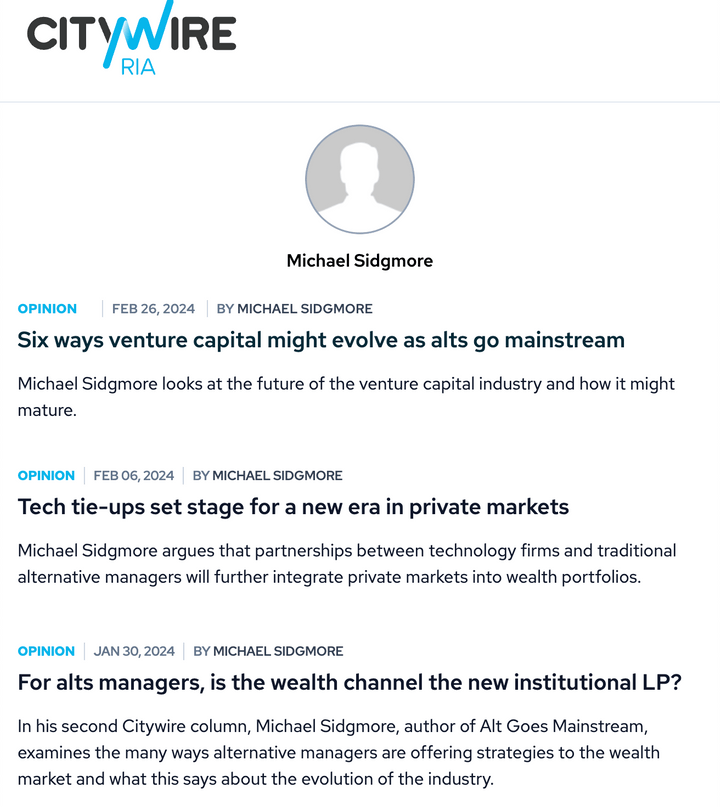

I am a frequent contributor to Citywire, the premier publication covering global asset management.

I’ve been an early investor in some of the online investment platforms, like iCapital, Republic, Forge (IPO), 73 Strings, Alt, CoinList, Allocate, Sorare, bunch, Brassica (acq. by BitGo), AltExchange (acq. by iCapital), Passthrough, Caplight, Capchase, Syndicate, DealsPlus, GP stakes firm Cantilever and others that are enabling alternatives to go mainstream.

I’ve been an operator as an early employee at two online investment platforms that have pioneered access to alternative investments.I was the first sales hire at Oakland-based Mosaic, a Warburg Pincus-backed company that has raised over $300 million in equity, which enabled retail investors to invest into home solar loans and has originated over $14B in home solar loans since inception.

Then, I moved to New York City and was pre-product, employee #9 at iCapital Network, where I helped build their investor network / sales team from a blank sheet of paper. At iCapital, we built a platform that has enabled the HNW community to access alternative investment funds at low minimums. We grew the platform to almost $3 billion in AUM in under 3 years before BlackRock invested into the company. iCapital is now the critical industry infrastructure for banks and wealth managers to access alternative investment funds, enabling over $200 billion in AUM to flow into private equity, venture capital, and hedge funds, and has raised over $700 million in equity from leading investors like BlackRock, Blackstone, Goldman Sachs, Apollo, WestCap, Ping An, Carlyle, and others.

I started my career as an investor at Goldman Sachs on their Principal Strategic Investments team, investing into FinTech and capital markets infrastructure, which has helped shape my view that alts are the next asset class to undergo a market structure evolution as equities and fixed income have done in the past.

~ writings~

We are at the dawn of an exciting time in the alternative asset space.

There will be companies that come to define this space and help usher alternative assets into the mainstream investing world.

This post maps out the alt assets space as we know it today. It defines what makes the potential Index Companies different and valuable, takes a look at who can be the potential Index Companies in this nascent space.

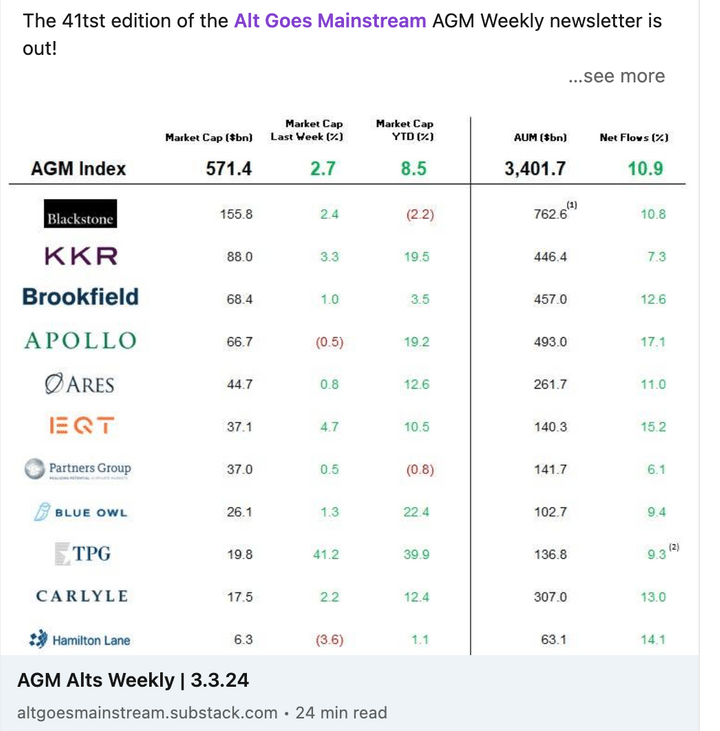

Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset manangers, job openings at private markets firms, and recent podcasts and thought pieces. Alt Goes Mainstream is read by thought leader from top thought leaders from top private markets firms like Blackstone, Apollo, Goldman Sachs, Ares, KKR, Carlyle, EQT, Blue Owl, Hamilton Lane, Franklin Templeton, Carlysyle, Fidelity, iCapital and many more

CityWire

As a frequent contributor to Citywire, I cover different aspects of the alts universe. Recent articles have included "Six ways venture capital might evolve as alts go mainstream,"Tech tie-ups set stage for a new era in private markets," and "What alts sales teams can learn from the rise of ETFs

Medium

Ride hailing apps like Uber, Lyft, and Didi Chuxing have unlocked an economic opportunity with the push of a button on a smartphone. In countries like Brazil, participation in the ride hailing economy is hindered by the fact that only 20% of Brazil's population owns a car. Kovi, a managed car rental marketplace for on-demand drivers, helps solve for the lack of car ownership and unlock economic opportunity for a large pool of potential drivers who otherwise would not be able to participate in the gig economy.

Medium

Fundraising is possibly one of the hardest things that an entrepreneur has to do. It’s also one of the most important.

This Medium post will be the first of a three-part series that will cover questions that entrepreneurs can ask their prospective VCs about their funds, how they think about board dynamics, and how they add value post-investment.

The Guardian

With a $41tn wealth transfer from baby boomers to millennials comes hope for a shift towards addressing the world's biggest problems.

In the first of a new series in the Guardian about millennials and sustainable finance, Michael Sidgmore talks profit with purpose.The Guardian

Peer-to-peer marketplaces have leveraged what venture capitalist Bill Gurley calls the "connective tissue of the internet" to bring us closer together. Some of today's marketplace businesses are now multi-billion dollar enterprises toppling the traditional incumbents in their respective industries.

While much has been discussed about why and how marketplace businesses are great business models, what is less often discussed is how marketplace business models can help solve some of the world's biggest problems.Alt Goes Mainstream is a content platform that delivers the latest developments in the alternative investments space directly to your inbox. There is everything from blog posts to podcasts with industry leaders to keep you up to speed with the latest trends in alternative investments.

Capital Allocators

On this episode of Capital Allocators, Michael joined Ted Seides to kick off his series on private wealth.

the10X Capital Podcast: How Everyday investors can access Blackstone, Apollo, and KKR

Michael Sidgmore of Broadhaven Ventures sits down with David Weisburd to talk about the growth of the wealth channel and its link to private equity. They discuss iCapital's rold in the venture world, access issues for family offices, and the strategies of Broadhaven Ventures. The conversation also covers GP Stakes, the future of emerging managers and the potential of IRA funds for venture capital and real estate investments.

Private Capital Podcast

with Joe Reilly

On the Private Capital Podcast, Joe Reilly has conversations with investment and business thought leaders geared toward the family office executive and wealth management industry. In this episode, he talks with Michael about the evolution of the alternative investment industry from early beginnings to where it is today and what that means for family offices and the wealth management industry.

Michael Sidgmore, an early-stage FinTech investor and Partner at Broadhaven Ventures, shares his insights on the future of democratized finance and how to invest in your passions.

Broadhaven Ventures' Michael Sidgmore on democratization of venture capital, why Alts are the future of private portfolios, and the role of wealth management firms.

Mike Packer, Partner at QED, and Michael Sidgmore, Partner at Broadhaven Ventures, are active investors in Latin America, with collective portfolio companies including Credijusto, Loft, Nubank and many more.

In this conversation, we discuss market dynamics, nuances and opportunities in Latin American fintech and much more.

In this episode of TEARSHEET, Micheal Sidgmore of Broadhaven Ventures talks to Suman Bhattacharyya about the diversity of pain points fintech companies are solving for globally and the evolution of the embedded finance paradigms among its portfolio companies and beyond.

Some conferences where I have spoken

IPEM Wealth

2026

Interviewer: "Alt Goes Mainstream Live: An architects view on the origins, evolution and outlook for evergreens" with Christopher Mauss, Partners Group

PEI Nexus 2026

Moderator: "The rise of semi-liquid fund structures: opportunities and risks for investors"

Interviewer: A conversation with Lawrence Calcano, Chairman & CEO of iCapital

Panelist: "Tactical & Strategic Opportunities: Wealth & Investment Management (Including WealthTech) Venture Capital & Growth Equity Investing and the Pathway to Initial Public Offerings (IPOs)"

Moderator: The Rise of Retail Investors in Alternative Assets.

Interview with Todd Myers, Global Chief Operating Officer of Private Wealth Solutions at Blackstone

Moderator: Unlocking Opportunities in Private Credit with Oaktree's Danielle Poli and Cliffwater's Phil Huber

with panelists Toni McDermott of Arrow Global, James Ruane of CDPQ, Reji Vettasseri of DECALIA Asset Management, and Matthew Potter of Pollen Street

Zurich 2023

Super Venture North America

New York 2023

Moderator: Snap back to reality - being bullish in a bear market

with Chenelle Ansah, Suranga Chandratillake, Maelle Gavet, and Jui Tan

Moderator: Everything you always wanted to know about VC (but were afraid to ask)

with Luca Bocchio, Anne-Charlotte Philbert and Stephanie Hospital

Panelist: Unicorn Breeding: Investing in the Best

Panelist: Strategic Opportunities: Venture Capital & Growth Equity: Investing Opportunities in B2C & B2B WealthTech

Moderator: Deciphering the equity equation. Interview with Henry Ward, CEO of Carta

Panelist: Default Alive: How Founders can survive a recession: with Aisha Gani, Pippa lamb, Harry Briggs, and Pegah Ebrahimi

Panelist: Global Investment in Football from the West to the Rest

Moderator: WealthTech: Empowering Individual Investors

Moderator: The everyday investor: Platforms making everyone a venture capitalist

Moderator: Will Payroll Loans Be the Next Big Thing in Incusion?

The Partners Summit

Panelist: "The Next5: Technology Trends"

BlockFin Summit

Moderator: "Investing in Cryptofunds"

Citywire Miami

Keynote Speaker: "Understanding the Digital Gold Rush"

Benzinga Fintech Summit

FinTech Silicon Valley

© 2020